China Industry Daily

Released in Beijing at 16:30:00 on April 27, 2023

In recent years, governments around the world have actively promoted the rapid development of the new energy vehicle industry, which has played a sustained high growth driving effect on the power battery industry. In the development process of related industries, the performance of Chinese enterprises and the Chinese market is very impressive, and it has become the main battlefield for the development of the global power battery industry.

One、 Market trends

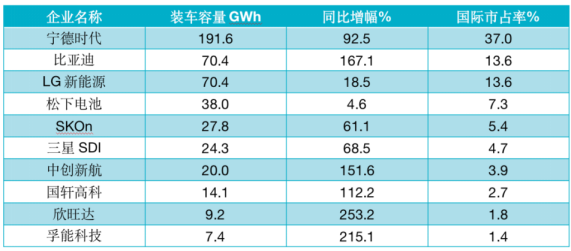

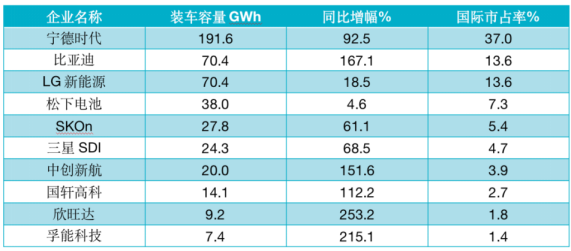

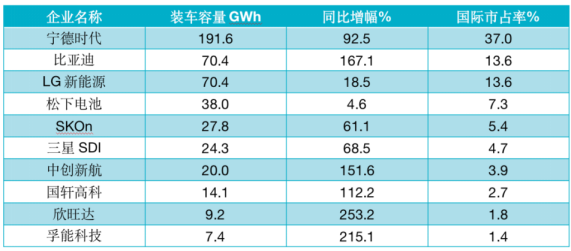

1. Ranking of Global Power Battery Enterprises in Market Share

2. Global explosive growth of new energy vehicles

The latest estimated data released by the International Energy Agency (IEA) shows that the global population of plug-in electric vehicles has reached 25.1 million in 2022, and it is expected to increase by 70.8 million in 2026, with a compound annual growth rate of 29.6%. Faced with the trend of electrification of automobiles, more and more international automotive companies are actively seeking transformation. According to incomplete statistics, currently 22 overseas car brands have proposed to stop selling gasoline vehicles by 2035.

3. The global power battery market is about to explode

The rapid development of the global new energy vehicle market will inevitably have a strong driving effect on the power battery market.

Nomura Securities predicts that the global demand for electric vehicle batteries will grow at a rate of 17% from 2023 to 2030; The global demand for electric vehicle batteries is approximately 1647 GWh in 2028, and approximately 2107 GWh in 2030.

According to the Lithium Battery Research Institute (GGII), the global shipment of lithium batteries is expected to reach 1165GWh by 2025. At that time, the shipment volume of energy storage batteries in China will reach 58.0 GWh, and the compound annual growth rate of the automotive power battery market will reach 29%; The shipment volume of power batteries for new energy vehicles will reach 470GWh, with a compound annual growth rate of 42.5%.

Two、 Market supply

Under the guidance of policies from various countries around the world and the plan of global car companies to stop selling fuel vehicles, the revenue expectations of power battery companies have rapidly expanded. Global power battery manufacturers are accelerating their expansion and layout, and power battery companies are accelerating their capacity expansion. Especially for Chinese power battery companies, their expansion speed is leading the world.

According to the latest data released by South Korean market research firm SNER Research, the global sales volume of power batteries in 2022 was 690GWh, and the market size of battery packs reached $125.5 billion. Among them, the top 10 companies with market share account for 93% of the global market in production and 91.4% in sales.

Three、 Competitive focus

1. Competition in lithium battery energy density technology

According to statistics, the supply of lithium has increased by 6% annually, nickel by 5%, and cobalt by 8% in the past 5 years. By 2030, the demand for lithium will increase by 30% annually, while the demand for nickel and cobalt will increase by 11% and 9% respectively.

In terms of raw material supply and extraction, due to the highly concentrated geographical distribution of key metals, their supply is relatively susceptible to policy shocks. Therefore, the International Energy Agency (IEA) pointed out that increasing the mineral density of batteries and controlling the size of batteries are two key means to effectively alleviate the pressure of excessive demand for key metals.

Nomura Securities believes that power battery technology is developing towards higher energy density, longer lifespan, and better thermal stability. For example, the innovative addition of silicon mixtures in anode materials is expected to increase the energy density of power batteries and reduce the industry's dependence on lithium ore.

Nomura Securities predicts that the energy density of NCM/NCMAEV batteries will reach 720-750Wh/L (280-310Wh/kg) by 2023; After 2025, the energy density is expected to reach 800Wh/L (320Wh/kg).

2. Competition in lithium ore resources and production costs

Driven by the production and sales trend of new energy vehicles, the price of lithium has been at a high level in 2022 and reached its highest point in mid December, which is $81412 per ton. In January and February 2023, lithium prices decreased by 7% and 13% month on month, respectively.

Nomura Securities believes that in recent years, the growth rate of lithium supply has exceeded the growth rate of demand. In the future, the focus of industry competition will be on high-quality mineral resources and lower production costs. Driven by such competition, it is expected that lithium prices will decrease by 20% to 35% year-on-year from 2023 to 2024.

3. Competition between different technological routes of sodium and lithium

Lithium ion batteries are highly dependent on lithium ore resources.

In the two types of lithium batteries, ternary lithium batteries and lithium iron phosphate batteries, the cost of cathode materials accounts for a large proportion and has been increasing year by year. Among them, the cost of positive electrodes for lithium iron phosphate batteries increased from 28% in 2018 to 46% in 2022, and the cost of positive electrodes for ternary lithium batteries increased from 50% in 2018 to 60% in 2022.

The abundance of lithium in the Earth's crust is 0.0065%, and China's lithium reserves only account for 7% of the world's total. Due to the surge in demand for new energy vehicles and energy storage batteries, the price of lithium carbonate is currently above 400000 yuan/ton.

Compared to lithium-ion batteries, sodium ion batteries have a significant cost advantage.

The upstream resource of sodium ion batteries is sodium. Sodium is abundant in the Earth's crust, with an abundance of 2.6%. The current market price of sodium carbonate, a raw material for sodium ion batteries, is only around 3000 yuan/ton.

According to calculations from Caitong Securities, layered oxide sodium ion batteries may be the first to be mass-produced in 2023, with a material cost of approximately 0.82 yuan/Wh during the pilot phase. After the large-scale production of sodium ion batteries, their cost competitiveness is more obvious, and the material cost is expected to be reduced to around 0.49 yuan/Wh, far lower than the material cost of lithium-ion batteries.

Caitong Securities predicts that sodium ion batteries will enter the first year of commercialization in 2023; In the future, the cost of layered metal oxide system sodium ion battery cells and polyanion system sodium ion battery cells will decrease to 490 yuan/kWh and 373 yuan/kWh respectively in 2025.

With the advancement of technology in lithium battery materials, battery cells, and system integration, the cost of lithium batteries will continue to decrease.

According to Caitong Securities, the cost of lithium iron phosphate batteries will decrease from 703 yuan/kWh in 2022 to 544 yuan/kWh in 2025; The cost of ternary lithium batteries will decrease from 887 yuan/kWh in 2022 to 741 yuan/kWh in 2025.

Data source:

Summary of the Development Report on China's Power Battery Industry (2022-2023) by Tencent News (qq.com)

![]() 2023.04.27

2023.04.27

![]() 2023.04.27

2023.04.27